Templates & Tips

This page will help you navigate building your Scorecard.vc listing, from tips around your description to templates that can help peak Investors ‘ interest. All templates are free and editable.

Quick Descriptions Tips

Your quick description links are what you used to “sell” someone on your opportunity, whether a Startup, Fund, or SPV raising capital, and even an Investor Deploying capital.

Use the following guides as a reference, and remember to keep your messaging concise –– you have a limited amount of characters, so choose your wording nicely (and do not use your company name here; we’ll add it for you).

Quick Pitch (Startups)

This is your elevator pitch, summarizing your entire listing. How can you describe your company in 5-7 words? You will need to nail this down before speaking with any investors, and try to remove any unnecessary words.

Example: Uber: “Cabs on demand”

Quick Thesis Description (Funds, SPVs & Investors)

What separates your Fund or SPV from others? Are you a strategic investor, do you have experience in VC from another fund, or something else unique? Both LPs and dealflow want to know what makes you special.

Example: LOUD Capital: “Creating profit with purpose”

Secret Weapon (Startups, Funds & SPVs)

Every company has competition, and Investors want to know what makes you special. Do you have a unique process, cheaper solutions, unique data, or something legally (patent or copyright) that makes you stand out?

Example: OpenAI: “Most advanced language learning model”

Revenue Strategy (Startups, Funds & SPVs)

As quickly as possible, describe how you make revenue. Outside of selling products or subscriptions, is there an advertising model nested within? For Funds/SPVs, do you pay a dividend or interest?

Example: Instacart: delivery fees + advertising

Customer Overview (Startups, Funds & SPVs)

Who do you serve? Is this a niche audience, or large population group? For Funds, are you investing in consumer or business-focused Startups?

Example: LinkedIn: business professionals + companies

Solution(s) Offered (Startups, Funds & SPVs)

How quickly can you describe your product, without any heavy tech language? For Funds, elaborate on your above Thesis with more info about strategic services, fund management experience, etc.

Example: Cameo: “celebrity digital personal greetings”

Problem Solving (Startups, Funds & SPVs)

What very specific problem are you working to solve? Try to aim for 5-7 words if possible.

Example: Scorecard: inefficient capital raising and investing

Templates

Click below to access and download our document templates to help you prepare to raise capital from Investors. All templates are free and developed by experts. Click here to return to the Help page for more assistance.

Pitch Deck

Learn what information you will need to create a pitch deck that will attract investors.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Competitive Landscape Matrix

Investors not only want to know about your competition, but they also want to know how well you understand the landscape.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Executive Summary

Often used as a predecessor to reviewing a full pitch deck, an executive summary will help investors understand the basics about your company before continuing the conversation.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Go To Market (GTM) Strategy

Your GTM Strategy includes everything from marketing, sales, business development, customer segments, and more, all of which investors need to know.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Exit Strategy

Want to really impress your investors? Present them with a full exit strategy to detail how, when, and by whom you could get acquired (as an alternate to an IPO).

Click the document image to access the template, and make a copy of the document to edit and personalize.

Term Sheet

While lead investors may present you with their own term sheet to sign, it is good to know what information you will need to expedite the process of closing investment.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Business Plan

Your business plan is a comprehensive document that showcases to investors your company, vision, strategy, and everything they will need to know.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Capitalization Table (Cap Table)

Your cap table will help you understand the ownership of your company, and investors will want to review before making commitments, even to see the cofounder splits.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Preferred Partner: Carta — Click here to get started for free!

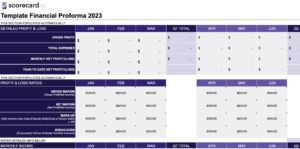

Pro Forma (Financials)

Your pro forma is a detailed financial breakdown of your company, including revenue, costs, and forecasts. This is one of the most important docs investors will want to review, so be sure to be as thorough as possible.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Fund/SPV Subscription Agreement Example

A Subscription Agreement is what Limited Partners (LPs) Investors will sign before you can receive their investment. This is a required document for all Funds/SPVs, and please remember this is only a reference example.

Click the document image to access the template, and make a copy of the document to edit and personalize.

Private Placement Memorandum (PPM)

A Venture Capital Fund PPM (Private Placement Memorandum) is a confidential legal document used in the fundraising process of a venture capital fund. It serves as an informational guide for potential investors, typically high-net-worth individuals, institutional investors, or accredited investors, who are considering investing in the fund. The PPM provides a comprehensive overview of the fund’s investment strategy, objectives, risks, terms, and other key details.

Click the document image to access the template, and make a copy of the document to edit and personalize.